People struggle. People suffer. People die of hunger. With out a doubt, we as a world have the technological resources to squash it out, but we do not have the infrastructure or social structure to allow these technologies to flourish, even though they are right there in our reach.

The American government is struggling, and that's just to do something essential that's a no brainier. It's pathetic. This system is almost worthless. Essentials should be automated. We don't have time for this bullshit.

All I see is ideological grandstanding. No science, no intelligence, no discussions, only rampant stupidity.

No science, no intelligence, no discussions, only rampant stupidity.

About sums up governments in general.

If anyone is going to fix the government, it certainly isn't going to be the government. Individual groups that can specialize in areas (finance, business, negotiations) are far better for the country than a bureaucracy, filled with people who have to vote on every decision.

As soon as there's a crowd, I'm in; and in hard. However, while the mantra is 'what can I do about it?' I'm keeping my head down.

Nice post, though.

Such cynicism! Try living in the dark ages, or during one of the world wars, for a year. Then come back here and learn to appreciate what we have.

Actually just because you have it well and your friends and family doesn't mean everyone does.

Such cynicism! Try living in the dark ages, or during one of the world wars, for a year. Then come back here and learn to appreciate what we have.

Cynicism != criticism. Nothing wrong with calling incompetence when you see it.

Mark, you could run for president, if it's a no brainer.

Hold up, pause the thread for a moment. Is that a chocolate keyboard? Alright, resume.

Raising the debt ceiling is not a "no brainer." It's a temporary fix that will only cause more out of control spending. The problem is nobody wants to cut any of their pet projects.

The "no brainer" is passing some sort of balanced budget act. Want to start up a new social program or build a bridge to nowhere? Better have the balls to raise taxes. (Want to cut taxes? Better cut some programs.)

It's sacrilegious to make changes to Social Security, despite it being one of the most idiotic schemes ever. The government shouldn't pay for old people's retirement. They should save their own money and live off of investments. Everybody who worked would be better off that way (have much more money). And if you cannot make it on your own, that's what relatives are for. That's worked for, I don't know, hundreds of thousands of years.

And likewise, if we aren't spending billions of dollars a month blowing up some country and putting it back together, we aren't patriotic.

Raising the debt ceiling is not a "no brainer." It's a temporary fix that will only cause more out of control spending.

And it worked fine for decades (not quite thousands of years, but getting there), which makes it correct, amirite?

Anyway, it's all a joke anyway. Whatever feeds the Daily Show fresh material is what's right in my book.

And it worked fine for decades (not quite thousands of years, but getting there), which makes it correct, amirite?

Not sure what you're getting at, but if we continue raising the debt ceiling and spending money, we will eventually be doomed. That is, the interest on our debt will be greater than total revenue. It hasn't "worked fine for decades" because at some point it will totally collapse.

Not raising the debt ceiling may cause a terrible hit to the economy in the short term, but it could just very well solve the long term problems that otherwise won't be going away.

But I fully expect both sides to strike a meaningless deal at the last second that raises the debt ceiling and does nothing else. The Republicans will hope to win the Senate in the next elections and then finally get some balanced budget policies in place.

And if you cannot make it on your own, that's what relatives are for.

Then don't complain when some mentally ill homeless guy robs you so he can get a shower and a sandwich. Gotta do what you gotta do.

Social programs for disabled people are a different topic... They are far less costly than something as general purpose as Social Security.

America is a broken nation and its too late to change that.

It hasn't "worked fine for decades" because at some point it will totally collapse.

Sure it has. No single debt limit increase had any end-of-the-world effect on anything, ever. I'm sure there is some larger, long term problem out there somewhere, but the debt limit increases (or even the concept of a debt limit) have nothing to do with it.

You wouldn't need to increase the debt limit if the budget passed the by the congress didn't go past the current limit. The budget was passed with the assumption that the debt limit would be raised accordingly (as it has been tens of times before without any issue), and therefore, it must be raised. End of story. If you don't like the debt, craft the budget such that it reduces it. Forbid debt limits and then craft the budget accordingly, not craft the budget assuming debt limit increases and then outlaw debt limit increases. One approach is a logical approach. The other one involves a gun and a foot.

I'm speaking of the mentality of spending more than you make. It isn't sustainable. The debt ceiling has nothing to do with that.

Of course it (the debt ceiling) is a stupid concept, and it shouldn't be the center piece of the debate, or used as leverage. But unfortunately it is the only trick that can be used to try to get some lasting and effective change.

At some point within 20-30 years at the current rates, we will be spending more on mandatory social programs than incoming revenue. Once that breaking point is reached, the amount of money spent on interest will grow exponentially.

And I think it's stupid to think that Congress can take care of the problem with good, old fashioned debate. If that worked, we wouldn't be in this mess to begin with.

Social programs for disabled people are a different topic...

Who said anything about social programs? I just like sandwiches, and they won't let you in if you haven't showered in months (I haven't.)

It's sacrilegious to make changes to Social Security, despite it being one of the most idiotic schemes ever. The government shouldn't pay for old people's retirement. They should save their own money and live off of investments.

I don't know how SS works, but afaik, CPP here in canada you pay into it every month you work. You have to. Its essentially a forced RRSP. You have every right to collect.

But unfortunately it is the only trick that can be used to try to get some lasting and effective change.

Too bad thats not what it's being used for. So far its all just shenanigans and petty bickering, even with in party lines. Its ridiculous. They really should sit down and compromise. Make some cuts, and let the Bush tax cuts lapse. Had they done that a couple years ago, there'd already be less debt, and probably wouldn't even need to raise the debt ceiling.

I don't know how SS works, but afaik, CPP here in canada you pay into it every month you work. You have to. Its essentially a forced RRSP. You have every right to collect.

One does not pay into Social Security so that he can take it back out. It doesn't work that way. The first people benefiting didn't put a dime into it. The current working generation is always paying for the retired generation.

I understand what you mean by having a "right to collect," but it's a fallacy to think of it as a personal savings plan. It's just a tax taken from your paycheck and given to somebody else. At the end of the day, it doesn't matter what label the government uses when it takes your money.

If it were about personal savings, then the government ought to mandate a private, personal investment plan where you get exactly what you put in. Then the 12% spent on Social Security can be reduced to something more manageable, like 2% for disability benefits.

One does not pay into Social Security so that he can take it back out. It doesn't work that way. The first people benefiting didn't put a dime into it. The current working generation is always paying for the retired generation.

Yes, you pay into it, so you can collect later. Sure, the money you gave them actually gets invested, and the proceeds of that go to people currently collecting, but you DO get a benefit from paying into it.

The current working generation is always paying for the retired generation.

If you like to think about it that way, the last generation paid for you. So really, no one is out of pocket, so long as no-one gets gypped.

The wars cost trillions in direct spending and the defense budget is ludicrous. Not to mention you guys still spend more on health care despite not having universal coverage. Health care is usually one of the largest expenses for a nation. Then you look at the taxation policy where the rich pretty much get a free lunch (despite the top few percent having the majority wealth concentration). Congrats at not looking outside of your own country for solutions to any problem. A made in america solution is always a poorly re-invented wheel. I don't want to be mean but your federal and state policies are ridiculous. I'm still amazed with all the MODERN problems in the world things like abortion, evolution, gun rights, and gay rights are still the talking points.

The debt ceiling was a good idea: A mechanism to prevent unlimited spending by the government, but since the government was generally just irresponsible enough to raise it every time the limit was reached, there was no point as it only wasted time having to get the branches of government agreeing to raise it.

Undoubtedly, both sides are posturing, but for the record, I agree with the Republicans taking a stand. Going trillions further into debt to pay for unfunded expenditures is just plain stupid. The States have to balance their budget (for good reasons), so as far as I'm concerned, any smart and honest person should agree the Fed should be required to do the same. No matter what, the debt should only be allowed to decrease, starting as soon as possible.

Going endlessly into debt to pay for Social programs is misguided Socialism. The ends don't always justify the means, regardless of what politicians on either side of the scale may say. I say make everybody pay a flat Federal tax rate (percentage), no loop holes, no exploiting people based on their pay grade. NO FEDERAL HANDOUTS FOR NON CITIZENS. We have enough of our own people to take care of without having to give freebies to illegal aliens. If the path to citizenship can be made easier, I'm all for it as long as it requires new citizens to carry their own weight and not be a burden on the rest of the country. I have read that gaining Mexican citizenship requires that, so if Mexico objects to that, they are hypocrites. Some people are genuinely too disabled for most kinds of work, but there are too many leeches in the system sucking the tax revenue dry, make them become productive and responsible members of society. I know some people who collect Welfare or Disability through their own laziness and irresponsibility, and it really annoys me because there are better ways for the government to allocate tax money.

Undoubtedly, both sides are posturing, but for the record, I agree with the Republicans taking a stand.

Stand on what? Their position is incoherent: they only care about keeping the tax cuts. The Democratic plans have been just as good or better at cutting the deficit, and yet because they ceased the tax breaks (or perhaps because they are Democratic in origin), they have been rejected.

NO FEDERAL HANDOUTS FOR NON CITIZENS. We have enough of our own people to take care of without having to give freebies to illegal aliens.

So, all non-citizens are illegal aliens?

Has Canada gotten the hockey riots under control yet?

Of course not. They're part of the constitution.

I wish I could opt out of social security. I don't need nor want the government's retirement package. Nevermind the fact that it will be even more beyond bankrupt by the time I'm of age to collect, if it even exists, it's a pretty crappy plan with stupid limitations. Let me manage my own money - the government can't even manage their own.

Of course not. They're part of the constitution.

So do you have the right to riot, or is it mandatory?

I wish I could opt out of social security

If you invested 10% of a meager $30,000 salary for 50 years and got average return rates, you'd end up with 1.2 MILLION dollars of personal savings. That would last you 40 years at your $30,000 salary.

And that still leaves 2% to 3% (since SS is more than 10%) that could be left for social programs for those who (really) cannot work.

So do you have the right to riot, or is it mandatory?

THIS. IS. CANADA.

Of course its mandatory. Honestly, what were you thinking?

If you invested 10% of a meager $30,000 salary for 50 years and got average return rates, you'd end up with 1.2 MILLION dollars of personal savings. That would last you 40 years at your $30,000 salary.

Math check :

(30,000 * 1/10) * 50 * ~1.1 = 165,000

That's approximately 5 1/2 years of living once you retire, assuming you keep spending money at the same rate. And for the people who can't afford to save any money - the people who barely get by paying their bills? WTF do they do when they turn 65? Social security is a good idea, and at least gives a small safety net to those with nothing.

The real problem is when Government borrows money from programs like social security and medicare, because they never pay it back. The government owes itself about 4.7 trillion dollars, borrowing from Peter to pay Paul.

You're reading the problem wrong, Edgar.

That is, assuming it is compounded yearly.

Well, I may have underestimated the effects of compound interest, but you're being rather generous with your figures.

Where do you think you're going to get a 6.7% return on your investment? Only lucky stock brokers make that much. More likely you get at most 4%, and most people who earn 30,000 a year have to go through at least 2 or 3 years of school. 65 - 21 = 44 years of saving.

So, $3,000 at 4% for 44 years :

$360,088.18

And at 30,000 a year that's still only 12 years. Hope you don't want to live past 77, or else you can go live in the street. And none of that accounts for the people who can't afford to save any money to begin with. Might as well send them off to the glue factory when they hit 65, because they won't have anything to live on.

Well, honestly, I was pulling interest rates out of my ass trying to come up with a figure close to ML's with a yearly compound and without actually doing any work.

Regardless, your figures are a bit off again.

So, at 4% for 44 years they have 18 years of savings before they hit debt, which puts them at 83 years old. Granted, six years isn't much of a difference, but it is just enough to put the bar past the average life expectancy (in the US, at least).

The masses have found out they can vote themselves bread and circuses. It'll take another few decades before they have any sense again.

To complicate the calculations further - most people earn less in the beginning of their careers than in the end. If 10% at the first year is only 1000$, it "becomes" 1000 * 1.04^50 = 7107$, compared to 21320$ if it was 3000$. The total difference shouldn't be that big, but it's still valid. You also need to take inflation into account (it's usually around 2% in Sweden, no idea about the US). What's the "living wage" in the US btw?

There is also the question of "helping people helping themselves" - someone might not start saving money until their 30s, since it seems so far off and there are more fun things to do with that money

*L0Ling at usa

I thought the OP was a song.

You guys are blind. The USA was planing to get rid of their debt by going to war with China. However China new this and countered. China has used its money and man power to rooted it self in many nations starting and paying for programs and building relationships. Its same thing the USA used to do.

So in the invent of a war they have many countries on their side. China makes its military mite known however they do not storm into conflit playing the role of a responsible big bother.

What the use is trying to do is turn everyone against China so they can have their war and get rid of the debt. Then India will be the new China. You ask why does USA need a "China"? Its because that's the only way to make and sell things so cheaply to the the people in the USA and to the contries that USA plays The role of the middle man too.

My figures are pessimistic:

Investments are shown to give 8% annually over the long run (i.e. 50 years) when you consider interest and reinvested dividends. (It's certainly been true for mine over the last 10 years.) I figured less than that.

Most people will average more than $30,000 / year over their lifetime. Even if your wage starts there, you're likely to get a minimum of 2% increase every year.

When you reach retirement age, you wouldn't stop making money off interest.

If you want to base it off of 40 solid years of working (25-65) with a intro salary of $30,000 and give yourself a 2% raise every year, you would have about $1 million in savings. If you moved the money into a safer, lower yield interest rate of around 4% at retirement, you could spend almost $40,000 / year and not lose any money!

You could live to infinity.

And none of that accounts for the people who can't afford to save any money to begin with.

You miss the point entirely! The government already takes around 12% of your income for Social Security and related programs. (Note that your employer pays around 6% of that, but in reality, it's just coming out of your paycheck too.)

If the government didn't take out that 12%, you would be free to invest it yourself.

There is also the question of "helping people helping themselves"

I understand that principle, and I think it is a smart one because you are right. The poor or stupid person would use Edgar's silly logic and not save the extra 12% they now have. But let me opt out of the "personal savings" aspect of SS, because I'm smart enough to save more money than the government will ever be able to give me via SS.

Is there an economy of scale at play here? Can the government (at least in theory) use the money in a better way than even a smart person could? If they were to invest the money, surely they could get better returns?

And if they simply make the current workers pay for the last generation of workers, they would get around the issue of inflation, and avoid giving money to banks needlessly. The problem with this is that the system can never stop...

So do you have the right to riot, or is it mandatory?

It's never stated explicitly that it's mandatory, but every good Canadian knows it's riot or GTFO.

I understand that principle, and I think it is a smart one because you are right. The poor or stupid person would use Edgar's silly logic and not save the extra 12% they now have. But let me opt out of the "personal savings" aspect of SS, because I'm smart enough to save more money than the government will ever be able to give me via SS.

We need to shackle people like you from making smart investments with your money because it makes dumb people look bad. That's why we have to force everyone to do the same mediocre investment scheme (Social Security) to equalize everyone's retirement into a semi-crappy one. What's 12% of your lives' income in comparison to making us all look the same regardless of how smart each of us is.

Can the government (at least in theory) use the money in a better way than even a smart person could? If they were to invest the money, surely they could get better returns?

This is the government ... of course they cannot use the money better than a smart person.

How can you invest money when you are immediately paying out more in benefits than you are collecting because this generation of workers is smaller than the number of retired people, and when the previous generation was larger you didn't save any of it? (This hasn't quite happened yet, but in a few years it will be losing money.)

We need to shackle people like you from making smart investments with your money because it makes dumb people look bad. That's why we have to force everyone to do the same mediocre investment scheme (Social Security) to equalize everyone's retirement into a semi-crappy one. What's 12% of your lives' income in comparison to making us all look the same regardless of how smart they are.

Yeah, because all smart people want to do is figure out how to get themselves richer, instead of actually tackling hard questions in science, medicine and other fields. I'd gladly take some (or a lot) of government inefficiency in exchange for being able to focus on what's actually important.

This is the government ... of course they cannot use the money better than a smart person.

That's just a non-argument. "The government is by default made of fail". Of COURSE it could, in theory, be better than a smart person at investing. They could hire good investors, for one. This assumes that investors are actually better than chance at investing (I was some report claiming otherwise recently).

But my questions were not rhetorical - I'm curious as to if there are benefits of scale when it comes to investments. I guess that's why there are collective investment schemes.

Of course, if the current pool of workers is smaller than the previous one, either the current one will have to pay more or it would have to be solved in some other way.

Yeah, because all smart people want to do is figure out how to get themselves richer, instead of actually tackling hard questions in science, medicine and other fields. I'd gladly take some (or a lot) of government inefficiency in exchange for being able to focus on what's actually important.

Yeah! Rich people are bad at science, all they know is money. We should raise SS to 24% use that money to pay scientists to discover science and medicine. The 7B/year with 0 revenue the government spends on science now is absurd! By doubling SS we can raise that to 700B/year and it can start getting real science done.

Private industry sucks, Genetech spends 6B/year (10B revenue) has only cured some kinds of cancer. And insulin is a crap invention, it's just making the rich richer.

The government needs to take over. Take a look at what it's discovered with it's 7B in taxes: http://www.nsf.gov/discoveries/disc_summ.jsp?cntn_id=114372&org=NSF

They've got things like:

"Tiny Torrents: Researchers Develop Powerful New Microchip-sized Fan"

"Ancient "Nutcracker Man" Challenges Ideas on Evolution of Human Diet"

"Platypus Genome Decoded"

"Species Have Come and Gone at Different Rates Than Previously Believed"

Who needs insulin, asthma treatments, blot clot treatments, cystic fibrosis treatments and cancer treatments when I can have the Platypus genome?

Wow, Dustin... I wish the Daily Show did a segment on you.

insulin

You mean the hormone that was discovered, developed into a treatment, and synthesized at state-funded universities?

Solid arguments, both of you.

See I thought he was being facetious. Maybe I'm just a sarcastic bastard, I dunno.

Of COURSE it could, in theory, be better than a smart person at investing.

In theory, an individual with a direct personal interest will do better than a politician seeking to win re-election. Show me a government that actually exists to serve its people for the "greater good," and then, in theory, I may agree with you.

But why does the government need to be in charge of investing money? Why not just mandate that 10% of the first $100,000 your pre-tax income must be placed into a personal retirement fund? You can then take 3% more for disability insurance.

With the current situation, you must a) cut benefits or b) raise taxes.

And since the typical politician only cares about getting re-elected (because it is his career), doing either of those two things are bad.

Yeah, because all smart people want to do is figure out how to get themselves richer

I'm not against an optional government personal savings plan for those who cannot be bothered to invest in private options. It's your loss, not mine.

I'm curious as to if there are benefits of scale when it comes to investments.

There's a reverse scaling effect. Generally speaking, the bigger the fund, the lower the returns. That's because 1) it's really hard to find worthwhile investments on such a grand scale, and 2) larger supply of investment funds means a lower interest rate (assuming constant demand for investment).

You can see it if you look back to the years 2005-2008, where investment firms were leveraging themselves chasing after smaller and smaller returns, chasing an every shrinking yield.

Can the government (at least in theory) use the money in a better way than even a smart person could?

Theoretically, it's possible. However, in practice, this doesn't happen. The only first-world country that has a solvent retirement program is Singapore (more on this further down).

There are multiple reasons for that:

1. Incentives. The incentives for government officials is either to just be re-elected 2 or 4 or 6 years down the road. That usually translates into vote buying, and not any real long-term investments. For government bureaucrats, the incentives are in keeping their jobs and/or budget, which are not always aligned with the incentives of the "investors".

You can argue that some of that occurs on the private side as well (and it does), but then comes my next point.

2. Feedback. Privately, you can't lose money forever. You can't borrow forever, and your investors don't have to put their money with you. Those constraints mean that you must actually deliver on your promises, both short term and long term, or go bankrupt. On the government side, governments can borrow nearly indefinitely, and force "investors" to hand them their money. Typically, people cannot chose to abandon the government plan and go with some different plan. At best, there's a vote every few years on a huge basket of issues, of which a tiny subset is the investments the government has made or might make.

This is a huge gap in terms of information & feedback between the two.

Again, this doesn't mean it's impossible for the government to do better in aggregate, or even in specific cases, but it makes it less likely.

Yes, you pay into it, so you can collect later. Sure, the money you gave them actually gets invested, and the proceeds of that go to people currently collecting, but you DO get a benefit from paying into it.

Both Social Security and the CPP work in very similar ways here:

- Current workers pay into the plan.

- The money collected is invested in the safest security available: government bonds.

- The government on the other side sees the new bond purchases and then gets excited about all those investors who are eager to loan to the government.

- The government spends this money in the general fund (ie: current programs & interest on the debt).

- Current retirees are paid out of the interest on their bonds (ie: interest on the debt from the general fund).

This system is sustainable if:

- The government gets a real return equal or greater than the payouts it needs. That is, it needs to invest it into real goods or service producing endeavors, and any money not invested into goods or services must be made up by a higher return on the money that is invested.

- or, population grows exponentially.

- or, taxes increase exponentially.

Unfortunately, none of those are or can be true indefinitely.

So the question now is: How does Singapore do it? Well, the Singapore system is very different from the ones in Canada, the US and most of Europe.

First, the government requires you to save 30% of your income. It doesn't matter how much you make, you save 30% of it. Make minimum wage? Save 30% of it.

Those savings go into an account with your name on it. Some portion of that money is available for your own investments (similar to an RRSP or a 401k). The savings can then be used to:

- Buy a house.

- Purchase health care or health insurance.

- Retire.

- Unemployment.

- Start a company.

That's pretty much it. For the really poor (think <= $10,000/year), there is a very minimal welfare system.

Since the money is in your name, and yours to invest, it's up to you to plan accordingly. There are no dependencies on later or previous generations outside of the investments made. The system is solvent and scale-free.

Edit:

I forgot to mention. The CPP and Social Security are not transferable except to your spouse (and children in very very limited cases). The returns on Social Security are also very low.

In other words, people are better off if they could take that 12% or so of your income that was put in SS, and instead just buy government bonds. The "investment" is the same, but the returns are much greater. In fact, just mandating that people buy government bonds with 12% of their income would be better than the current SS system.

I hope one of the Bush crime family squirrels get their heads blown off!

Also, this debt ceiling panic is complete theatrics.

For one thing, the Social Security "Trust Fund" and the Medicare "Trust Fund" can be redeemed into regular treasuries without hitting the debt ceiling. So these programs won't be a problem for another 3 years.

The Federal government also has about $1.5 trillion in unused assets can be auctioned off (large stacks of gold, land, oil, buildings, etc). So the government can keep funding itself for at least another year.

That should give Congress plenty of time to figure out what the next steps are. There's no need to go in all-panic mode right now.

Why would the government decide that entitlement programs (Social Security, specifically) are fair game? Especially when they are not a significant contributor to the debt.

Spoiler: Entitlements are a significant amount of Federal spending, growing larger every year.

Their position is incoherent: they only care about keeping the tax cuts. The Democratic plans have been just as good or better at cutting the deficit, and yet because they ceased the tax breaks (or perhaps because they are Democratic in origin), they have been rejected.

That claim about the Republicans is a Democrat lie that conveniently ignores a major part of the issue, which is that spending is and has been out of control. The stance I'm interested in is the refusal to just continue raising the debt ceiling irresponsibly without doing something to curb spending. The last comprehensive summary I read about a recent Democrat proposal was that they'd mostly create "savings" by increasing taxes for the rich and slashing the Defense budget.

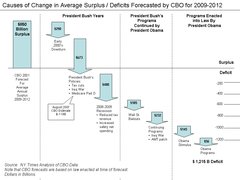

This is another popcorn thread for me, but I found a chart called The Chart That Should Accompany All Discussions of the Debt Ceiling, so I guess it needs to go in here somewhere ...

Chart?!

But Obama's out of control spending is the real problem here. That's clearly the truth because it's what I've been told over and over again.

This is exactly what I'm talking about. The actual truth is only about... oh 2% relevant.

Nobody has any incentive to do research or practical thinking, or letting the best ideas be discovered.

People who do "research" never let it speak for itself. "I have the facts right here!" Sure you do.

"Truth," for all practical purposes is whatever arbitrary idea that's reinforced the most. It helps a lot if it resonates with a voter's belief system. That's all that matters here. That's the only force that carries any significant weight for voters.

Everything is used for a selfish purpose.

This system is all fucked!

No science, no intelligence, only rampant stupidity followed by rampant pandering. How do you win? Pander to the most easily manipulated and controllable sect of the public: the stupid people.

We need smart, educated people to guide us. Following along with what the masses are told to want is a recipe for disaster.

Is it just me or does is seem like the forces that control the people seem to be getting stronger? Could just be my mood.

This is another popcorn thread for me, but I found a chart called The Chart That Should Accompany All Discussions of the Debt Ceiling [www.theatlantic.com], so I guess it needs to go in here somewhere ...

I really can't believe the New York Times published that, they've gone off the deep end.

I'm incredulously aware how that chart makes people feel about the debt during his presidency. The basis for it is nothing short of insane -- It would be like crashing into something at high speed and getting excited about how you're "pressing the gas pedal less hard".

Here's a chart that refrains from outrageous goals of misinterpretation:

{"name":"CBO_Forecast_Changes_for_2009-2012.png","src":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/6\/3\/63c5cddb709cbea72135e0183c3ad025.png","w":960,"h":720,"tn":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/6\/3\/63c5cddb709cbea72135e0183c3ad025"}

Only a politician would view tax cuts as a "cost" to the government, as if it's something it is paying for.

Chart?!But Obama's out of control spending is the real problem here. That's clearly the truth because it's what I've been told over and over again.This is exactly what I'm talking about. The actual truth is only about... oh 2% relevant.Nobody has any incentive to do research or practical thinking, or letting the best ideas be discovered.

People who do "research" never let it speak for itself. "I have the facts right here!" Sure you do.

"Truth," for all practical purposes is whatever arbitrary idea that's reinforced the most. It helps a lot if it resonates with a voter's belief system. That's all that matters here. That's the only force that carries any significant weight for voters.

Everything is used for a selfish purpose.This system is all ed!  No science, no intelligence, only rampant stupidity followed by rampant pandering. How do you win? Pander to the most easily manipulated and controllable sect of the public: the stupid people.We need smart, educated people to guide us. Following along with what the masses are told to want is a recipe for disaster.Is it just me or does is seem like the forces that control the people seem to be getting stronger? Could just be my mood.

No science, no intelligence, only rampant stupidity followed by rampant pandering. How do you win? Pander to the most easily manipulated and controllable sect of the public: the stupid people.We need smart, educated people to guide us. Following along with what the masses are told to want is a recipe for disaster.Is it just me or does is seem like the forces that control the people seem to be getting stronger? Could just be my mood.

{"name":"604610","src":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/4\/9\/495f62c2a7b8cadcc871e3d2cc6b7587.jpg","w":500,"h":333,"tn":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/4\/9\/495f62c2a7b8cadcc871e3d2cc6b7587"}

I only skimmed Mark's post the first time but now I noticed something I'd like to respond to:

Is it just me or does is seem like the forces that control the people seem to be getting stronger? Could just be my mood.

I've noticed the opposite, all the "on the road to" socialists have been getting really quiet and people on the margin are becoming conservative. Everyone's[1] getting conservative friendly. I think recessions do that to people.

References

- Is it everyone's or everyones'?

Everyone's

Yes. Since it's a contraction for "everyone is."

Only a politician would view tax cuts as a "cost" to the government, as if it's something it is paying for.

It's worse than that, the tax "cuts" are simply reductions in projected increases, not actual lower taxes.

[EDIT]

Is it just me or does is seem like the forces that control the people seem to be getting stronger? Could just be my mood.

The pendulum will swing back yet again eventually. Politicians heads will roll, preferably not via guillotine.

Some of you USsers really do need to spend some time living in a covilised country, because you're talking total bollocks when it comes to social programs and free market economy. Anyway, it's your country, you can fuck it up as much as you like. I don't have to live there, so what do I care.

(end frustrated rant).

Ok, I do care. In a large part because a financial crisis in the US is going to take the rest of the world with it. Apart from that, as I said, I don't care so much since it's your country and I don't have to live there.

Where would you recommend a fellow USer live?

I'm seriously tired of the US. Our people are lazy, apathetic, powerless, and stupid. Failure is inevitable.

Some of you USsers really do need to spend some time living in a covilised country

You might be right, but that reminds me of the story of the old Bostonian woman who was asked if she'd ever traveled. She replied "I never had to travel, I was born here!".

America is the best!

Yes, AMERICA. We own that word. GO AMERICA!!! WOOHOOOOOO!

Mark is an unpatriotic traitor who deserves to get run over by a football team.

PS: We beat Canada at hockey and caused their entire country to riot.

who deserves to get run over by a football team.

Did he mean a handegg team?

You only call it handegg 'cause you have weird shapes in your country, probably cause you're measuring everything in those funny sounding inches!

Hand Ball

{"name":"SoloAPMarkDuncan430.jpg","src":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/f\/7\/f7acbe98dea2aaab0d9f5d3b08336b64.jpg","w":430,"h":618,"tn":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/f\/7\/f7acbe98dea2aaab0d9f5d3b08336b64"}

Foot Egg

{"name":"93538965.jpg.29728_crop_340x234.jpg","src":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/e\/a\/ea02ec0d885611d3f6b1dbe2084ff9d2.jpg","w":340,"h":234,"tn":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/e\/a\/ea02ec0d885611d3f6b1dbe2084ff9d2"}

Bat Ball

{"name":"wii%20sports%20baeball%20tips.jpg","src":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/2\/9\/29a030bec0cc20d3613fbe103b7b0105.jpg","w":634,"h":447,"tn":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/2\/9\/29a030bec0cc20d3613fbe103b7b0105"}

Only a politician would view tax cuts as a "cost" to the government, as if it's something it is paying for.

Or an economist because guess where you might consider taxes on the balance sheet.

Assets: Anything being owned or controlled to produce value.

Liabilities: An obligation (such as a loan).

Equity: Your assets worth after all liabilities are paid out.

Where would you recommend a fellow USer live?

I know a lot of americans who are happy here up in canada. Just stay away from toronto or alberta.

What are you on? I live in the rockies in AB and it's literally paradise here.

Your hockey riots aren't big enough.

Ya but you should see our skiing riots.

Where would you recommend a fellow USer live?

I'm seriously tired of the US. Our people are lazy, apathetic, powerless, and stupid. Failure is inevitable.

I'm guessing you'll find a lot more of that where Evert is idealizing. It's in the nature of people to be that way.

Better to just ignore them, they're everywhere and not going away.

Just stay away from toronto or alberta.

You dislike me that much?

Seriously though, I like Alberta.

Hehe.. you albertans are funny. I'd rather live in calgary than toronto but your provincial politics kind of suck.

Hehe.. you albertans are funny. I'd rather live in calgary than toronto but your provincial politics kind of suck.

I've completely tuned myself out of Provincial, and civic politics for the most part. Some federal stuff slips by. And some civic stuff wrt the new rink/arena and development of the former city center airport and anthony henday (ring road).

Otherwise I've just gotten tired of the jibber jabber. There's no one here to make jokes like Jon Stewart or Stephen Colbert

There's no one here to make jokes like Jon Stewart or Stephen Colbert

I like Infoman, but that's in French and mainly Quebec centric.

Imagine 100 people. 80 people divide 7% of the net earned wealth for themselves. Most of the 71 of these guys work pretty hard but 9 of them are unemployed. There are 19 guys who split the next 50% of the wealth. One guy gets 43% of the wealth. He must either be working really, really hard or maybe it's that the others are giving him nearly 43 percent of their wealth. Which sounds more plausible? (Stats from 2007 USA)

Arthur Kalliokoski, I respect your view of not wanting to take advantage of the wealth of others. But you've said your position is in making very little money and your admirably humble perspective skews your perspective. Most Americans work harder than you and the top one percent's wealth is mostly made off of the sweat of others. They have way, way more than is reasonable compensation for what they do. Money isn't distributed morally for work done by default. It's distributed exponentially by default. A progressive tax scheme is a great balance in reality. The Bush Tax cuts did not create jobs. They merely removed a system that helped make wealth be distributed in a slightly more fair manner. If a few lazy bums sponge up at the bottom in a Socialist program, that's a shame but it's less of a travesty (statistically and morally) than what's happening.

Edit: this is long enough

Or an economist because guess where you might consider taxes on the balance sheet.

Assets: Anything being owned or controlled to produce value.

Liabilities: An obligation (such as a loan).

Equity: Your assets worth after all liabilities are paid out.

The real truth is, money that is not legally collected (ie. as taxes) is NOT the government's money, and therefore it is improper to count it as an asset. This kind of "it's our money before we collect it" thinking is why the government has been able to get this far into the red. If they had to balance the damn budget, this wouldn't have happened.

In any case, the wealthiest already collectively pay the most in taxes. Wealth distribution is forced charity, and I don't believe in it. Simplifying the tax code by starting at a flat rate instead of all the different brackets, loopholes, exemptions and other nonsense will help individuals and businesses in the fairest manner possible without giving tax cuts, which is favoritism.

They need a book that explains it.

{"name":"obamamarxismfordummies.jpg","src":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/b\/f\/bf31919e3a632b83105877279779dce6.jpg","w":319,"h":400,"tn":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/b\/f\/bf31919e3a632b83105877279779dce6"}

Wealth distribution is forced charity, and I don't believe in it. Simplifying the tax code by starting at a flat rate

If you don't believe in wealth distribution, you want an actual flat tax, not a flat rate.

In any case, the wealthiest already collectively pay the most in taxes.

Maybe. Maybe. Most of them get away with paying almost no, or no tax at all. They clearly don't pay their share. I say take out all the tax loopholes, and leave the tax rate where it is.

Wealth means how much money you already have. Tax doesn't apply to that. High rates of income are taxed, but if you cut their throat with taxes, they'll just stop "working". Why work if someone's just going to rob you? Those naive liberals can't seem to learn from history or common sense. It does enable politicians to change the subject though, as the politics of envy are very persuasive.

Um, did something funny happen in the USA today? The way I'm hearing people talk, the Congress and Senate just gave up their authority to Obama and 13 yes-men .. sounds democratic, whatever it is!

if you cut their throat with taxes, they'll just stop "working"

So making people actually pay their taxes is tantamount to cutting their throat?

Um, did something funny happen in the USA today?

No... Congress agreed to raise the debt limit and promise to talk about making cuts in the future. Just as expected.

So making people actually pay their taxes is tantamount to cutting their throat?

There have to be some taxes, sure, but not when you're going to waste it making millionaire farmers rich with gasohol and paying them not to grow stuff, or wasting it making the dictators of third world nations rich when they sell off the foreign aid, or getting involved in Middle East countries that have been more or less at war for 8000 years. It also cuts back on production, since the punitive tax rates discourage it. Hell, I read something a couple days ago about how IT infrastructure has used less power than projected because of the recession.

Isn't it kind of laughable the debt ceiling? Has anyone ever looked at how much debt we have? How about a plan to lower that debt....instead we fight for months to raise it...

I wonder what other countries think of us?

Thanks

Mike Williams

I wonder what other countries think of us?

I stumbled across this earlier today:

It sounds like the USA is fucked[1].  Which is scary when you think about it.

Which is scary when you think about it.  What the Hell is going to happen to this rock with somebody else in power, like China, India, or Russia?

What the Hell is going to happen to this rock with somebody else in power, like China, India, or Russia?

References

- I imagine Canada is fucked too.

If you don't believe in wealth distribution, you want an actual flat tax, not a flat rate.

I would want everybody to pay the same percentage. I'd call that a tax rate, and not wealth distribution because everybody's paying the same relative amount. Having everybody pay the same absolute amount would not be feasible because lower income citizens cannot pay as much in dollars as higher income citizens. This means everybody would either pay a smaller absolute amount (not enough taxes collected to pay for government services) or lower income citizens would need to be given tax breaks (effectively destroying any notion of a flat tax rate).

Maybe. Maybe. Most of them get away with paying almost no, or no tax at all. They clearly don't pay their share. I say take out all the tax loopholes, and leave the tax rate where it is.

Maybe you should actually look up some real numbers instead of believing the lies you're fed. Try some IRS data on for size:

http://www.taxfoundation.org/news/show/250.html

The top 1% of wealthiest tax payers paid 38% of all income taxes in 2008. The lowest 50% of wealthiest tax payers paid 12.75% of all income taxes. But why not make them pay less and bleed the richest even drier?

When the government robs Peter to pay Paul, they can always count on the support of Paul.

Closely related:

Getting a man to understand the rightness of something is extremely difficult when his income depends on not understanding it.

The top 1% of wealthiest tax payers paid 38% of all income taxes in 2008. The lowest 50% of wealthiest tax payers paid 12.75% of all income taxes. But why not make them pay less and bleed the richest even drier?

drier than the top 1% having 60% or more of all the money? Sure. I don't mind that at all. The richest pay the least percentage of tax based on the actual income. They pay a lot of people to find them ways to NOT pay tax. Due to the fact that they earn and have a lot more money, they pay more tax in an absolute sense. But that's not the issue here.

They pay a lot of people to find them ways to NOT pay tax.

Hence the flat rate tax. Due to corrupt politicians accepting bribescontributions, the tax code is riddled with exceptions. That's not the fault of Adam Smith or capitalism, but just human nature (greedy politicians float to the top and lazy citizens don't kick them out).

It would help if the government didn't pander to every special interest group and egg on the lazy ignorant bums who expect the government to provide things "for free".

A good example of government waste are the bunny inspectors.

I bet the latest version of Madame Defarge is in high school already.

Income tax is silly, no matter how it is implemented.

I'd rather there be a federal consumption tax. You can hide income by moving it around, but you cannot hide the purchase of a million dollar yacht.

You can hide income by moving it around, but you cannot hide the purchase of a million dollar yacht.

Just buy it overseas with cash you stealthily also store overseas.

Well, hell, let's just tax the whole world. Obama would like that!

drier than the top 1% having 60% or more of all the money? Sure. I don't mind that at all. The richest pay the least percentage of tax based on the actual income. They pay a lot of people to find them ways to NOT pay tax. Due to the fact that they earn and have a lot more money, they pay more tax in an absolute sense. But that's not the issue here.

Who cares how much of the total percent they have? How it gets spent or saved is what affects the US economy. Your "actual income" claim isn't backed up with anything to justify it, unless I missed something here. The statistics I cited directly refute your claim, saying that the top 1% of wealthiest tax payers had the highest average tax rate of all brackets listed. Do note that table 1 says TAXES PAID, meaning these amounts weren't weaseled out of with breaks and loop holes, it is the amount that the government collected. How about you reply with real information instead of Liberal lies?

For those keeping track, statistics establish that the wealthiest already pay the most income taxes in both absolute and relative terms, but apparently there's no convincing some people. I don't see how Democrats can argue against such numbers and claim the rich aren't paying enough and actually believe it. It only makes sense that they're trying to mislead the public so they'll go along with wealth redistribution during the "transformation" of the USA into a Socialist country.

Just buy it overseas with cash you stealthily also store overseas.

Regarding a yacht, you'd still have to have it registered. Without the sales/import tax paper, that wouldn't be possible. But it's just an example... It's generally easier to hide income once than try to hide every thing you purchase.

Ron Paul claimed during the last elections that the increase in government purchases over the last ~15 years actually exceeded the entire income tax. So theoretically, if the government returned to prior spending limits, you could get rid of income tax altogether (and replace it with nothing).

The larger point is no matter how you look at it, the government needs to collect money regardless of what method is used. So it ought to use methods that are hard to cheat and easy to keep track. Income tax is neither of those two things. It's a ridiculously complex system with too many exemptions and loopholes and cheats.

It's crazy that people are so stuck on income tax as the benchmark of who pays taxes. It's only a single method... somebody who pays no income tax is not somebody who pays no taxes.

How about you reply with real information instead of Liberal lies?

How bout you stop being insulting and biased?

That's weak, dude.

That's weak, dude.

Yes, what he said was very weak.

IS NOT! I'LL HOLD MY BREATH UNTIL I TURN BLUE! oh wait...

Personally, I enjoy watching educated discussion intertwined with, shall I say, a more common approach to these matters.

Anyway, all these career politicians held to the flame here, they aren't as idiotic, short sighted, and self serving as opinion claims. Alright, well, maybe they are quite close, but the trouble isn't finding a solution which creates a sustainable system, the problem they are trying to work out is migrating toward a sustainable system without losing enough stability to get them voted out and replaced with someone who will head in the other direction.

Your average voter is all for what appears to be a free handout. Something like social security? If you just shut that down the long term may get much brighter, but you also suddenly gain a few million people with no source of income and remove the planned source of income for a few million more. It takes longer than six years for the benefits of that change to become apparent and thus it is almost impossible to make it happen.

What we need is a good intermediary step. I'm empty for ideas, but, it isn't really my job to care about such things.

{"name":"Dzp5P.jpg","src":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/4\/3\/43c57e17ff5371a8202dcaef9f6714f1.jpg","w":795,"h":800,"tn":"\/\/djungxnpq2nug.cloudfront.net\/image\/cache\/4\/3\/43c57e17ff5371a8202dcaef9f6714f1"}

Are people signing up for this forum just to post in this thread, or is someone creating a lot of sockpuppets?

Proganisms perhaps ;-)

It's only SEO spammers adjusting to common anti-spamming safeguards. They are starting to realize that accounts that sit idle are often automatically deleted, and that they must post something that doesn't look like complete nonsense to get around that.

So hiring Indian labor for spamming has officially become cheaper than using bots/Xrumer then?

It's more effective on active sites, at least. The approach is:

Sign up

Leave a comment on a thread such that it looks like you know what you're talking about

Come back later and fill in your profile with spam

That helps prevent against sites that delete ghost accounts. And by waiting a bit to put in the spam, you may avoid getting caught by an admin who only looks at the recent entries.

The top 1% of wealthiest tax payers paid 38% of all income taxes in 2008.

The top 1% has about 40% of our country's wealth. That's quite close to the percent of taxes they pay. Don't talk like they are being bled to death, and don't get pissy. I'm going to take a wild guess and assume you aren't in the top 1%, so why do you care?

Also what is wrong with socialism? We have social security, TANF, SNAP, WIC, and a host of socialist programs here in the states. Define what is bad about socialism before you go using it negatively.

Define what is bad about socialism before you go using it negatively.

Everybody's equal under communism, but some are more equal than others.

Same for capitalism.

"Under capitalism, man exploits man. Under communism, it's exactly the opposite".

"From each according to his ability, to each according to his need"

Sure, I'd love communism or ObamaCare if I didn't want to work. "I have a hangnail, so I can't do X, but I need a 40 plasma TV".

How many of you wanting this sort of crap are on the public dole already?

@Arthur: I said socialism. Its not the same thing as communism. Google it.

I also never said I wanted the programs i listed. Welfare and Social Security would be the first things gone if I was the all powerful politigod.

I'm all for paying people's living expenses if they can't work. But I would change a few things:

No cash/checks: the government will seek out the cheapest rent in town for your household size and pay the landlord directly. Utilities are covered up to the mean for the area/household size/building type you live in. Any excess is up to the person in question.

No food stamps: No trading food credits for money or buying JuJuBees because they are 'food'. Government cheese was good enough for my grandma, and its good enough for anybody else. If you don't want to eat cheap food, then you aren't hungry.

I think we can come to agree on some points...

@Arthur: I said socialism. Its not the same thing as communism. Google it.

The Marxist conception of socialism is that of a specific historical phase that will displace capitalism and precede communism. The major characteristics of socialism (particularly as conceived by Marx and Engels after the Paris Commune of 1871) are that the proletariat will control the means of production through a workers' state erected by the workers in their interests. Economic activity would still be organised through the use of incentive systems and social classes would still exist, but to a lesser and diminishing extent than under capitalism.

[1]

OK, so I did. Socialism is the embryonic stage of communism. Your point is?

[EDIT]

No food stamps: No trading food credits for money or buying JuJuBees because they are 'food'. Government cheese was good enough for my grandma, and its good enough for anybody else. If you don't want to eat cheap food, then you aren't hungry.

I knew a guy about 6 years ago who'd find someone to go in a store with him, they'd select what they wanted, he'd put it in his cart, then they'd go outside, load up the food in the other guy's car, who'd pay the thief about 30 cents on the dollar. He'd go back in the store and buy cases of beer with the cash. It's like the analog hole for digital media, you can't prevent people from gaming the system one way or the other.

I never said we should be communist or socialist. I said define what is wrong with socialism. I feel that socialism has its place in our lives (albeit not the current implementations, by far).

Also, socialism is only the embryonic stage of communism to Marx and his ilk. Read this. The basic definition at the top has nothing with Marx.

What is wrong with having that?

EDIT:

About foodstamps: I know people who do that right now. I'd solve the solution by never letting them choose what to buy in the first place. The only people who can pay for food 30 cents on the dollar are people who have money; they normally aren't into cheap cheese and cranberry juice.

A political and economic theory of social organization that advocates that the means of production, distribution, and exchange should be owned or regulated by the community as a whole

That's the first definition of the first hit. Notice it says community, not the state. So if you know of someone in your neighborhood who's old and crippled with arthritis or whatever, go out and buy them something, get together with some neighbors to build them a wheelchair ramp or whatever, don't waste several weeks of your life each year earning enough to let the government waste your paycheck on it.

Actually Google uses 'define' as a keyword, much like 'translate'. Notice that there is no big blue link at the top of it. Its not a site its a service from google.

Its nice that you and your community were able to come together and help the elderly. In my neck of the woods though, people only look out for themselves. There are always community projects, but they are poorly organized, not well directed, distributed, or funded. Its like we are missing something... like a decision making body of sorts... with deep pockets.

In my neck of the woods though, people only look out for themselves.

Sounds to me like decent people need to move then. Why should some government type come in there and force them to do something the selfish types don't want to do? Especially given that so much waste goes on when it's part of a giant bureaucratic ball of mud?

Maybe people could be more generous if they didn't have to slavedonate more than 1/4 of their work to the "magnanimous" government.

Jonatan, that's a cool link.

In the table 'tax freedom days for countries by date' it lists the tax burden percent for each country. India is the only country with less of a tax burden than us. I can't say that taxes are a good thing based on this table, but I can say we have very little to complain about.

We should be complaining more about how it is allocated, and less about the amount.

How bout you stop being insulting and biased?

Because I'm not fond of liars.

The top 1% has about 40% of our country's wealth. That's quite close to the percent of taxes they pay. Don't talk like they are being bled to death, and don't get pissy. I'm going to take a wild guess and assume you aren't in the top 1%, so why do you care?

I certainly am not in the upper wealth class, I just don't believe in forced charity. I believe in everybody pulling their own weight to maintain the country and its services. To me, "fair share" is everybody paying the same relative tax rate (a percentage), not people paying a disproportionately higher amount of taxes just because they earn more revenue.

Also what is wrong with socialism? We have social security, TANF, SNAP, WIC, and a host of socialist programs here in the states. Define what is bad about socialism before you go using it negatively.

As I stated above, it's against what I value. I value people and families taking care of themselves. I believe the Federal government overstepped its authority when it created those programs.

I said define what is wrong with socialism.

What's wrong is that too many humans are lazy and greedy, I don't see how government could ever get efficient enough so that only people that actually meet the appropriate criteria receive entitlements. But getting that under control would require even more regulation and thus more government, or the current regulation would have to be severely improved.

We should be complaining more about how it is allocated, and less about the amount.

Agreed. I wouldn't complain about paying higher taxes IF the increased revenue only went toward paying off the Federal debt. I'd be surprised if the debt was ever returned to zero.

I certainly am not in the upper wealth class, I just don't believe in forced charity. I believe in everybody pulling their own weight to maintain the country and its services. To me, "fair share" is everybody paying the same relative tax rate (a percentage), not people paying a disproportionately higher amount of taxes just because they earn more revenue.

The thing is, if someone earns more money, then a they will have a disproportionally higher discretionary income. For that reason alone I think it makes sense for the tax rate to be higher - and you can think of it as being a flat rate on discretionary income if you like. The full story is a lot more complicated that just that; I just think that's one good reason for a variable tax rate.

Another way of looking at it is that each dollar of money is worth less to people who have a lot of money, compared to people who have very little money.

The thing is, if someone earns more money, then a they will have a disproportionally higher discretionary income.

If the extra income is going to be taxed away, why would they bother making more money? Or even part of it, since the ratio of effort to income would presumably have diminishing returns like most things.

If the extra income is going to be taxed away, why would they bother making more money? Or even part of it, since the ratio of effort to income would presumably have diminishing returns like most things.

Income is what is being taxed. So more income is still more money regardless of what the tax rate is - the incentive might be slightly reduced, but it will still be there. It may be slightly harder to become ridiculously rich, but if people still want to be rich, then they will still be doing the same things. Do you think that having a higher tax rate would make people not want to be rich? (I'm not a tax expert, or an economics expert; so I apologise if I'm getting wrong.)

One of these brass oldies is a phrase that has been a perennial favorite of the left, "tax cuts for the rich." How long ago was this refuted? More than 80 years ago, the "tax cuts for the rich" argument was refuted, both in theory and in practice, by Andrew Mellon, who was Secretary of the Treasury in the 1920s.

Then as now, there were people who failed to make the distinction between tax rates and tax revenues. Mellon said, "It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue for the Government, and that more revenue may often be obtained by lower rates."

[1]

If the extra income is going to be taxed away, why would they bother making more money?

Well, not ALL of it obviously.

Or even part of it, since the ratio of effort to income would presumably have diminishing returns like most things.

Mo' money == mo' money. The people this would apply to are millionaires and billionaires; they'll be fine.

Or you could say that a high tax rate is an incentive to make more money because you need to make more to take home more.

Money is power. With great power (money) comes great responsibility. Paying your taxes is taking care of your responsibilities to society. I agree with Karadoc.

Having those who make the most contribute the most is just common sense. Even if they pay a higher tax rate than everyone else, they are still making more than everyone else so what's the big deal? I don't see why rich people are more special than other people, they just happened to have more resources to begin with. It takes money to make money. The rich get richer, and the poor stay poor because of it.

The rich get richer, and the poor stay poor because of it.

So you think the economy is a zero-sum game? Make your own car then. From scratch.

[EDIT]

And what about that reference I posted? Your wishful thinking trumps history or what?

So you think the economy is a zero-sum game? Make your own car then. From scratch.

Zero sum? I don't know what you're talking about. I'm talking about distribution of wealth, and it is disproportionate. I couldn't make my own car, I don't have the capital to build a factory, much less even order all the parts I would need. So you just proved my point - it takes money to make money, so the distribution of wealth just gets farther and farther apart when considering the distance between the rich and the poor.

Zero sum? I don't know what you're talking about.

It's rather obvious you don't know much about economics, but wouldn't you agree that if you had to make your own car and the auto worker had to write his own programs you'd be much worse off than you are now? Henry Ford didn't have a factory to make his first car.

http://everydayecon.wordpress.com/2006/10/11/economics-is-not-a-zero-sum-game/

[EDIT]

The desire to work is disproportionate as well. Let's make everybody work the same if they're going to make the same amount of money. Too bad that leaves out designing car engines, writing computer programs and managing corporations, since those are worth more than flipping burgers. And before you object, "golden parachutes" for CEO's aren't the fault of capitalism or economics.

Another way of looking at it is that each dollar of money is worth less to people who have a lot of money, compared to people who have very little money.

"Because they can afford to pay more taxes" is not what I consider a valid reason to charge some people more taxes, it's a rationale for the government to bleed more money from the citizens.

Paying your taxes is taking care of your responsibilities to society.

I disagree with this. It is not one stranger's responsibility to financially care for another stranger. Paying less in taxes and then using that savings to invest more in the local economy is what we should want. When American businesses feel like they're being taxed too much, they move outside the country, and it hurts the USA. Seems like a pattern to me.

Having those who make the most contribute the most is just common sense. Even if they pay a higher tax rate than everyone else, they are still making more than everyone else so what's the big deal? I don't see why rich people are more special than other people, they just happened to have more resources to begin with. It takes money to make money. The rich get richer, and the poor stay poor because of it.

It's not common sense, it's an excuse for charging some people a higher rate than others. Charging everybody the same rate is the closest thing that could be universally agreed to be "fair", doing otherwise is treating some people "specially". It's not as if every rich person was born rich. Some people started with little and became rich with good fortune, habits, ideas, investments, etc. One person being successful does not prevent another from being unsuccessful. There are many other factors involved.

At what point did I say that workers should work at jobs they are unskilled at? That doesn't make any sense.

Henry Ford didn't have a factory to make his first car.

No, but he had to at least have the materials and equipment necessary to put one together. That's called capital. Rich people have it, poor people don't.

I disagree with this. It is not one stranger's responsibility to financially care for another stranger. Paying less in taxes and then using that savings to invest more in the local economy is what we should want. When American businesses feel like they're being taxed too much, they move outside the country, and it hurts the USA. Seems like a pattern to me.

So you think no one should pay taxes at all then? Okay, so who do we convince to build our roads for free? Or our schools, or our sewers, or anything else that the government takes care of for the public good?

Businesses are leaving the country because poor countries are so desperate to have jobs they'll accept deficient wages, and so the businesses can squeeze even more profit out of people.

No, but he had to at least have the materials and equipment necessary to put one together. That's called capital. Rich people have it, poor people don't.

Nowhere in the wikipedia article do I see any indication that he was born rich or that some other rich person helped him through some misguided sense of charity. He worked and saved and innovated.

Charging everybody the same rate is the closest thing that could be universally agreed to be "fair"

To be "fair," people would only pay for the services they use. End of story.

Taking money from the rich, even if at the same percentage of the middle class, and giving the money to someone else is not "fair" to the rich person. It's not "fair" to be born to a poor family in the ghetto. That person is at a distinct disadvantage to somebody born to a rich family.

It's all about finding the greatest good for all of the nation. If you tax the rich too much, then they may find ways to lower their income (legal or not). If you tax them too little, then the poor people are unnecessarily left out in the cold.

There's a happy medium somewhere between the two, and it has nothing to do with using the same tax rate for all people.

Why does discussing politics cause people to discard logic? And why do we let that phenomenon be responsible for how our government works?

"Because they can afford to pay more taxes" is not what I consider a valid reason to charge some people more taxes, it's a rationale for the government to bleed more money from the citizens.

It's more subtle that just being able to afford it. Let me give a silly little example: parking fines. In many countries parking fines are a flat fee. If you park your car where you aren't meant to, you have to pay X dollars. For an ordinary person X dollars might be a serious inconvenience, but for a rich person X dollars is pretty small. Thus rich people (and organisations) can pay for the right to park their car wherever they like. The cost of the parking fine is the same in terms of dollars, but there is some measure of value for which the parking fine is cheaper for the rich person. The key point is that the same money is more valuable to the poor person than to the rich person. If you want to have a flat tax rate based on that kind of value, then the rate based on dollars should be higher for higher incomes.

And what about that reference I posted? Your wishful thinking trumps history or what?

I'm pretty sure that we all understand the distinction between tax rates and tax revenues. And although "more revenue may often be obtained by lower rates", that doesn't mean "more revenue may always be obtained by lower rates". Presumably there is some kind of optimum. I don't know what the optimum tax rates are, but I suspect it is not optimal to have a flat rate for all citizens.

Let's make everybody work the same if they're going to make the same amount of money.

No. Because it's stupid. And no one suggested it.

OK, to be "fair", consider some level of income as "survival" level, say, $10,000.00 US. I've lived off that (or less) for the last 35 years without whining for govt. handouts (although there were a few unpaid debts along the way).

Now count that as "zero" and tax some set amount above that at a set rate, maybe 10% (hey, it's good enough for the church). So someone making $100K a year would pay $9000 a year.

Of course this doesn't take into account the fact that different areas of the US don't have wildly different costs of living just to get by.

[EDIT]

No. Because it's stupid. And no one suggested it.

Wanting the government to give lazy bums everybody elses money is stupid too, but it's quite attractive for the bums.

I'm going to take a wild guess and assume you aren't in the top 1%, so why do you care?

That's a silly argument. Personally I try to vote for what I consider correct and just, not what I would gain the most from. It's about sustainability. If you bleed the richest people dry, they would find ways to prevent it altogether (moving their money/themselves to another country for example), leaving you with far less money than what you started with. Thankfully, politicians are painfully aware of this.

When I discuss politics with friends the subject of "fairness" is invariably brought up, indicating that their view of fairness is the universally correct one. The truth is that fairness is a very subjective issue, and a law that is "fair" in one way is usually "unfair" in another. I think we should try to strive for a balance that gives the most benefit to the most number of people, while at the same time treating everyone as equals (Eg; generic and simple rules with less special cases). Easier said than done, certainly.

It may be slightly harder to become ridiculously rich, but if people still want to be rich, then they will still be doing the same things. Do you think that having a higher tax rate would make people not want to be rich?

It makes people avoid riskier business deals and focus on avoiding losses. Here's a simple explanation:

If I lose money, I lose 100% of it.

If I gain money, I gain 60% of it.

The result is less investment in longer term stuff, less investment in crazier ideas and a general movement towards lethargy. There is a clear and obvious example of the effects of this sort (ie. messing with time based volatility): Go to a city with rent control. Every building is unmaintained and crappy, landlords don't invest in making them nice. The paint is peeling, they're never remodeled, the facets are old, the elevators are old etc.

If I lose money, I lose 100% of it.

If I gain money, I gain 60% of it.

Those percentages are not talking about the same thing ... it's almost meaningless to use them like that. If you gain money (a lot of money), you gain 60% of the profits. That could be 200% of your investment.

Go to a city without rent control. Every building is unmaintained and crappy, landlords don't invest in making them nice. The paint is peeling, they're never remodeled, the facets are old, the elevators are old etc.

FTFY.

Those percentages are not talking about the same thing ... it's almost meaningless to use them like that. If you gain money (a lot of money), you gain 60% of the profits. That could be 200% of your investment.

Its not my point and I've articulated it poorly, let me quote him directly.

When a corporation loses a hundred cents of every dollar it loses, and is permitted to keep only 60 cents of every dollar it gains, and when it cannot offset its years of losses against its years of gains, or cannot do so adequately, its policies are affected. It does not expand its operations, or it expands only those attended with a minimum of risk. People who recognize this situation are deterred from starting new enterprises. Thus old employers do not give more employment, or not as much more as they might have; and others decide not to become employers at all. Improved machinery and better-equipped factories come into existence much more slowly than they otherwise would. The result in the long run is that consumers are prevented from getting better and cheaper products, and that real wages are held down.

[1]

I think that's a very narrow view, Dustin. Sure, less money = less black to play with. However, doing business is still better than not doing business. You still make more money. 60% of something is more than 100% of nothing. It isn't necessarily good to invest in risky opportunities, but then those are always a gamble so I don't see what taxes have to do with it.  If you lose you lose no matter what. If you gain you gain no matter what. You might gain less if some of it is going towards taxes, but those taxes are responsible for maintaining necessary parts of the system all around you that you depend on...

If you lose you lose no matter what. If you gain you gain no matter what. You might gain less if some of it is going towards taxes, but those taxes are responsible for maintaining necessary parts of the system all around you that you depend on...